Advanced Cash Flow Forecasting Techniques for Uncertain Times

In today's volatile economic environment, accurate cash flow forecasting has never been more important for businesses of all types. Traditional forecasting methods fail when faced with unprecedented uncertainty and change. This article explores the advanced techniques finance professionals can use to improve the accuracy and reliability of cash flow forecasts.

We'll examine how to use data analytics, scenario planning and artificial intelligence to create more robust forecasts. We'll also look at how to account for more volatility, risk analysis and collaboration across the business. By using these advanced methods, businesses will better understand their future cash position and make better financial decisions.

Why Effective Cash Flow Forecasting in Uncertain Times

Cash is the lifeblood of any business, and effective cash flow management is key to survival and growth - especially in times of economic turmoil. An accurate cash flow forecast gives you:

However, traditional forecasting methods rely on historical data and assume a stable business environment. In times of high uncertainty, these methods quickly become unreliable. Advanced techniques are needed to create forecasts that respond to changing conditions.

The Cash Flow Forecasting Landscape

Traditional cash flow forecasting methods rely heavily on historical data, assuming a stable business environment with predictable patterns. These methods involve extrapolating past trends, applying fixed growth rates or using simple statistical methods to forecast future cash flows. However, effectively managing and consolidating cash flow data can significantly enhance the accuracy of these forecasts.

While these work in stable times, they fail in today's fast-changing business world. The modern world is full of factors that make cash inflows and outflows more unpredictable:

In this environment traditional forecasting models that rely on past performance and linear projections can't cope with these variables. So businesses are turning to more advanced data driven cash flow forecasting.

Data Analytics

One of the best ways to improve cash flow forecasting is through the use of advanced data analytics. By incorporating cash flow projections, which extend further into the future compared to short-term forecasts, businesses can enhance their financial planning and decision-making. By using larger datasets and more complex analysis, you can find more insights and patterns that impact cash flows.

The first step in applying advanced analytics to cash flow forecasting is to broaden the range of data sources. Instead of just historical financial data, modern forecasting uses a wide range of inputs. These might include:

For example, a manufacturing company might combine data on raw material prices, supplier lead times, production efficiency metrics, and macroeconomic indicators to forecast future cash outflows in production costs. A retail business might combine point-of-sale data, foot traffic, weather and social media sentiment analysis to forecast future sales and cash inflows.

Once you have a rich dataset you can then increase the granularity of the forecast. Instead of broad top line projections, advanced analytics allows for more detailed bottom up forecasting. Cash flows can be broken down by business unit, product line, customer segment or even individual customer or SKU (Stock-Keeping-Unit) level. This granularity improves overall accuracy and gives you more insight into the drivers of cash flow variability.

With a full dataset and granularity in place, you can then apply advanced statistical methods to find trends, relationships and patterns. Some of these methods include:

The appeal of these advanced analytics approaches is not just in the ability to process large amounts of data but in their ability to learn and adapt over time. As new data comes in the models can adjust automatically so forecasts remain relevant even as business changes.

However, the output of these complex models needs to be interpretable and actionable for decision-makers. This is where data visualisation comes in. Interactive dashboards and visual analytics tools allow stakeholders to explore the forecast data, understand the drivers and quickly see the implications of different scenarios.

By using advanced analytics in this way, you can move beyond trend extrapolation to create dynamic, multi-dimensional forecasts that give you a much broader view of future cash flows.

Scenario Planning and Sensitivity Analysis

In uncertain times, you need to move beyond single-point forecasts and consider a range of possible outcomes. Scenario planning and sensitivity analysis are powerful tools that allow you to explore how different factors will impact future cash inflows and prepare for different possible futures.

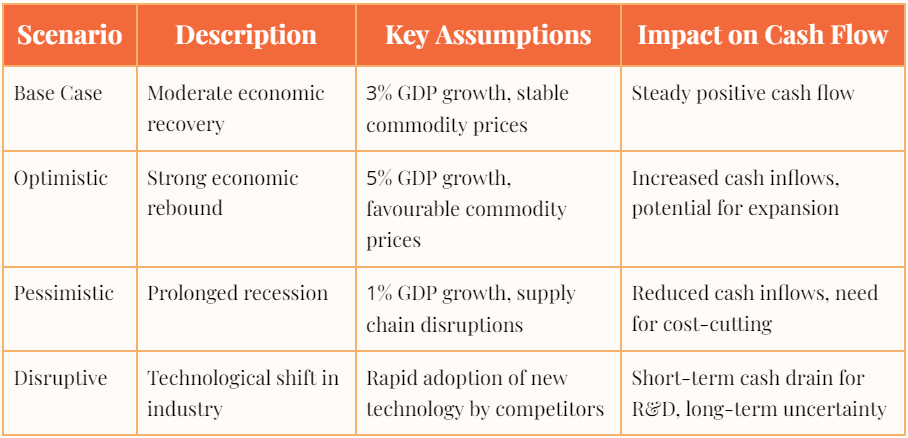

Scenario planning involves creating multiple plausible future scenarios based on different combinations of key variables. The process starts by identifying the most important factors that will impact the business's cash flows. These might be macroeconomic variables like GDP growth or interest rates, industry-specific variables like regulatory changes or technological disruption, or company-specific variables like the success of a new product launch or the outcome of a major contract negotiation.

Once these drivers are identified the next step is to create a set of scenarios that represent different possible futures. You need to balance this – the scenarios should cover a wide range of possibilities but not too many (typically 3-5) to not overwhelm decision makers.

For each scenario the impact on cash flows is then modelled in detail. This might involve changing assumptions around revenue growth, cost structures, working capital requirements and capital expenditure. The result is a set of cash flow forecasts for each scenario giving you a broader view of the possible outcomes.

Here's an example of what scenario planning might look like for a mid-sized manufacturing company:

Sensitivity analysis complements scenario planning by varying individual inputs to see how they impact the forecast. This helps you to identify which factors have the biggest impact on cash flows and where to focus your risk mitigation. For example, a sensitivity analysis might show that a 1% change in raw material prices has a much bigger impact on cash flow than a 1% change in labour costs, so you know where to focus your hedging or cost control.

Together scenario planning and sensitivity analysis give you a more detailed view of future cash flows and the drivers of those cash flows. This allows you to develop more robust strategies and contingency plans and be better prepared for uncertain environments.

Risk Analysis in Forecasts

Traditional cash flow forecasts don't adequately account for risk and uncertainty. Advanced forecasting techniques incorporate robust risk analysis to give a more realistic view of possible outcomes, helping to anticipate and address potential cash shortages.

The first step in risk-adjusted forecasting is to systematically identify and list the various risks that will impact cash flows. These might be:

For each risk, the potential financial impact is estimated and the probability of occurrence. This can be tricky, often requiring a combination of historical data analysis, expert judgement and external research.

Once risks are identified and quantified, they can be added to the cash flow forecast using various techniques. One common approach is Monte Carlo simulation, which involves running thousands of simulations with different combinations of risk events to produce a probability distribution of possible cash flow outcomes.

The result is a more detailed view of future cash flows. Instead of a single-point estimate, decision-makers can see the full range of possible outcomes and their probabilities. For example, instead of forecasting a $10 million operating cash flow for the next quarter, a risk-adjusted forecast might show:

This gives you more informed decision making and better risk management. It allows you to identify cash shortfalls before they happen and develop contingency plans to fix them.

Plus, by quantifying and modelling risks, you can prioritise your risk management efforts. You can focus on the risks that have the biggest impact on cash flows rather than spreading resources thinly across all possible risks.

AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are changing many aspects of financial management including cash flow forecasting. These technologies can analyse vast amounts of data, detect complex patterns and learn and improve over time.

Understanding free cash flow is crucial for effective budgeting and managing financial stability, especially for small businesses.

Some key applications of AI/ML in cash flow forecasting are:

For example, a large retail business might use an AI-powered forecasting system that combines point-of-sale data, inventory levels, weather forecasts, social media sentiment, and macroeconomic indicators to forecast cash inflows at a store-by-store level. The system can update its predictions in real-time based on live data, so the forecasts are up to date and take into account the latest trends and events.

While implementing AI/ML systems requires a big upfront investment, they can improve forecast accuracy and free up finance teams to focus on higher-value analysis and decision-making. But remember, these are not magic bullets. They still require human oversight and judgement, especially when interpreting results and making strategic decisions based on forecasts.

Rolling Forecasts and Continuous Planning

In fast changing environments annual budgets and static forecasts become obsolete quickly. Many organisations are moving to rolling forecasts and continuous planning to keep forecasts up to date and understand how much cash is expected to flow in and out of the business.

Key characteristics of rolling forecasts are:

This allows businesses to be more agile and responsive to changing conditions. It promotes a more forward-looking mindset across the organisation and aligns financial planning with operational reality.

Implementing a rolling forecast process involves:

Rolling forecasts can offer several advantages over annual budgeting:

But implementing rolling forecasts comes with challenges. It requires a cultural shift to more frequent planning and continuous reassessment of assumptions. It also requires more input from across the organisation which can be time consuming if not managed properly.

Better Collaboration for Better Forecasts

Cash flow forecasting shouldn't just belong to the finance team; it needs input from all parts of the organisation for accuracy. Advanced forecasting processes encourage cross-functional collaboration and information sharing.

Introducing the concept of net cash flow is essential in this context. Net cash flow, calculated by subtracting total cash outflows from cash inflows, indicates whether cash reserves have increased or decreased during the forecasting period. Understanding this helps in assessing a company's cash position over a specified period.

To enhance collaborative forecasting, start by defining the process. This involves outlining roles, responsibilities, and input timelines to show how each part contributes to the bigger picture. Training the team is crucial to ensure all stakeholders grasp the importance of accurate forecasts and how to provide quality inputs. This may include teaching forecasting techniques, data analysis, or using specific tools.

Utilising collaborative tools is key. Implement software that allows seamless data sharing and version control. Cloud-based planning platforms enable multiple users to input data and view real-time results. Establish feedback loops to regularly review forecast accuracy and identify areas for improvement. Compare actuals to forecasts and analyse any variances.

It's important to align incentives towards accurate forecasting rather than overly optimistic or pessimistic predictions. Consider incorporating forecast accuracy into performance evaluations. Foster a culture of transparency by encouraging open communication about potential risks and opportunities affecting cash flows. Cultivate an environment where sharing both good and bad news is comfortable.

Leverage cross-functional teams for forecasting by involving finance, sales, operations, and other relevant departments. This approach provides a comprehensive view of cash flow drivers. Breaking down silos and fostering a planning culture enables organisations to access a broader knowledge base for improved forecasts.

Cash Flow Visibility

A key challenge in cash flow forecasting is having visibility into all the drivers of cash. Advanced forecasting techniques focus on improving this visibility through better data integration and real-time monitoring.

Consider the following steps:

By having visibility, businesses can react faster to changing conditions and make better cash management decisions. This visibility also enables better working capital management so organisations can use cash more efficiently and reduce borrowing costs.

Accounting for Increased Volatility

Traditional forecasting methods assume a relatively stable business environment. In today's world we need to explicitly account for increased volatility in our projections. This means a change of mind set and methodology.

Methods for modelling volatility in cash flow forecasts:

Accounting for volatility can help businesses create more realistic forecasts and be better prepared for cash position swings. It will also help create a more agile decision-making culture where leaders can react quickly to changing circumstances.

Long-Term Forecasting Accuracy

While short-term cash flow forecasting is crucial for day-to-day operations, businesses also require long-term projections for strategic planning. Advanced methods play a key role in enhancing long-term forecasting accuracy. One approach involves reconciling high-level strategic projections with detailed operational forecasts, known as top-down and bottom-up forecasting. This method helps identify gaps and provides a more balanced view of future cash flows.

Another significant aspect is factoring in external data, such as economic indicators and industry trends that impact long-term performance. Collaborating with economic research firms or utilising big data analytics can aid in identifying relevant trends. Additionally, probabilistic forecasting, which offers ranges or confidence intervals instead of point estimates, is essential to acknowledge uncertainties and provide decision-makers with a clearer overview of potential outcomes.

Regularly reviewing and updating long-term forecasts is crucial. Treating long-term forecasts as living documents that are periodically revised to incorporate new information and market changes can help in making accurate decisions. Backtesting past forecasts against actual results is a systematic way to refine methodologies, identify biases, and drive continuous improvement.

Scenario planning involves developing multiple long-term scenarios to prepare for different possible futures, enabling businesses to create robust strategies. Utilising advanced modelling techniques like system dynamics or agent-based modelling can capture complex interactions and feedback loops affecting long-term cash flows.

While long-term forecasts will always carry a degree of uncertainty, these methods provide valuable guidance for strategic decision-making. Improving long-term forecasting enables businesses to make informed choices regarding capital allocation, investment strategies, and long-term financial planning.

Technology for Forecasting

Advanced cash flow forecasting relies on technology to process vast amounts of data, perform complex calculations and provide real-time insights. Key technologies that can help:

When choosing technology solutions, one should consider ease of use, scalability, integration, and total cost of ownership. The aim is to create a flexible forecasting platform that can adapt to changing business needs.

Conclusion

Advanced cash flow forecasting is now a necessity in today's uncertain world. By leveraging data analytics, AI, and scenario planning, organisations can create precise forecasts, enhance data sources, and integrate robust risk analysis. This approach, along with rolling forecasts and cross-functional collaboration, ensures agility in financial planning and quicker responses to market shifts.

Continuous refinement and adaptation of forecasting methods are crucial in navigating complexity and seizing growth opportunities. Businesses that prioritise enhancing their forecasting capabilities will bolster financial resilience, maintain competitiveness, and thrive amidst uncertainty.

With the increasing need for accurate and adaptable forecasting, businesses are turning to advanced technology solutions like Fyorin's financial operations software. Our platform centralises and enhances data from multiple financial sources, enabling organisations like yours to adapt to market shifts and swiftly make informed strategic decisions. Get in touch today.